Independent Loan Charge Review

Independent Loan Charge Review

Our London office insolvency practitioners look at the Chancellor’s announcement of an independent review of the Loan Charge.

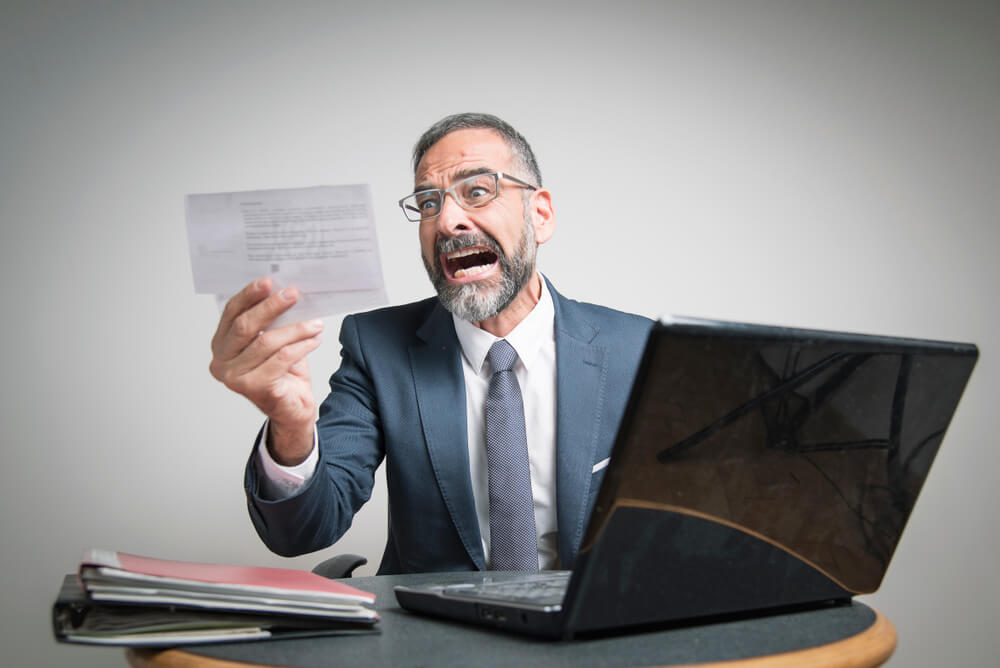

The Loan Charge is Causing Huge Mental Stress

What’s Happening with the Loan Charge? Huge Amounts of Stress and Also Reports of Suicides

We have read reports in the national press about the Loan Charge causing huge mental stress with the shocking news that several suicides have happened.

Employee Benefit Trusts. Can’t Pay the Loan Charge?

Employee Benefit Trusts. Can’t Pay the Loan Charge?

If you haven’t settled the tax owed on your employee benefit trust and can’t afford to pay the Loan Charge, talk to our Insolvency Practitioners for help.

Employee Benefit Trusts. Is HMRC Softening its Stance?

Employee Benefit Trusts. Is HMRC Softening its Stance?

HMRC has suggested those freelance contractors earning under £30,000 could be given 7 years to pay the Loan Charge as a result of Employee Benefit Trusts or other disguised remuneration loans. Not a big concession, we argue.

Employee Benefit Trusts, the Loan Charge and HMRC’s Hard Line

Employee Benefit Trusts, the Loan Charge and HMRC’s Hard Line

Employee Benefit Trusts. Can we really expect the Government to respond positively to the House of Lords Economic Affairs Committee’s recommendations to soften HMRC’s approach to EBTs and the April 2019 Loan Charge?

Professional Footballers, HMRC, Employee Benefit Trusts and Tax Advice

Professional Footballers, HMRC, Employee Benefit Trusts and Tax Advice

HMRC is investigating the tax affairs of 171 professional football players over Employee Benefit Trusts, Film Schemes and Image Rights – up 91% in one year. Often the issue is poor financial advice. We can negotiate with HMRC if you have an EBT, or similar issue, and help mitigate losses incurred.

Employee Benefit Trusts. HMRC Too Aggressive?

Is HMRC’s approach to Tax Avoidance too aggressive?

The House of Lords questions HMRC’s powers over its Aggressive Approach to Tax Avoidance, including Employee Benefit Trusts (EBT). Our London Team reports.

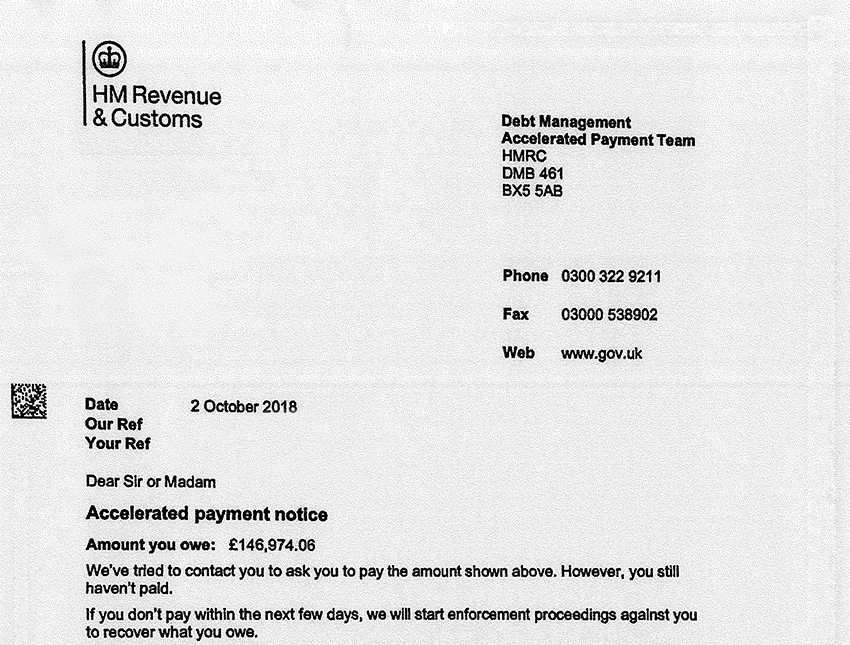

HMRC Aggressively Chasing Payment of APNs

HMRC Aggressively Chasing Payment of Accelerated Payment Notices

HMRC is Knocking on Doors for Payment of Accelerated Payment Notices. They can then start enforcement proceedings. Insolvency could be the outcome. Talk to us for help & advice

Employee Benefit Trusts and the April 2019 Loan Charge

Employee Benefit Trusts and the April 2019 Loan Charge

50,000 people with Employee Benefit Trusts need to Contact HMRC by Sept 30th 2018 to try and avoid the April 2019 Loan Charge. Talk to us for help & advice.

The April 2019 Loan Charge – Employee Benefit Trusts and Insolvency

The April 2019 Loan Charge – Employee Benefit Trusts and Insolvency

The Government Continues to Toughen its Stance with the April 2019 Loan Charge. This significant change could see the tax liability of an EBT jump from the Company to Individual Directors.