Company Voluntary Arrangements Vs Pre-Pack Administrations

Company Voluntary Arrangements Vs Pre-Pack Administrations

The ABc London team compares company voluntary arrangements with the popular but sometimes controversial pre-pack. CVAs have many advantages for all sizes of company.

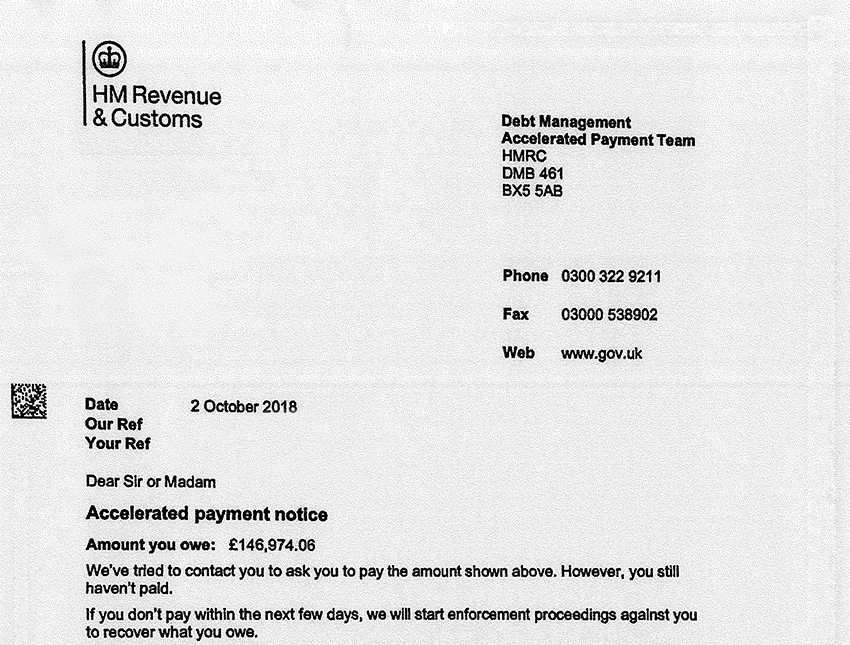

HMRC Aggressively Chasing Payment of APNs

HMRC Aggressively Chasing Payment of Accelerated Payment Notices

HMRC is Knocking on Doors for Payment of Accelerated Payment Notices. They can then start enforcement proceedings. Insolvency could be the outcome. Talk to us for help & advice

Insolvency Practitoners’ Update – Company Voluntary Arrangements

High Street Company Voluntary Arrangements – Is the Process Being Abused?

High Street Company Voluntary Arrangements have been heavily in the news this year, but is the process being abused? Is reform needed? Our London based insolvency practitioners comment.

HMRC to Become a Secondary Preferential Creditor

HMRC to Become a Secondary Preferential Creditor

Our London Team of Insolvency Practitioners comment on HMRC being reinstated as secondary preferential creditor. What are the implications for insolvency?

Stopping Entrepreneurs’ Relief and Members Voluntary Liquidations

Stopping Entrepreneurs’ Relief and Members Voluntary Liquidations

Will Philip Hammond stop Entrepreneurs’ Relief? If yes, what will be the effect on Members Voluntary Liquidations? Bring plans forward say our London team.

Primera Air Collapses

Primera Air Collapses

This article by our London Team of Insolvency Practitioners looks at why Primera Air filed for bankruptcy & whether customers will get their money back.

Company Voluntary Arrangements – Not Just for Retail or Restaurants

Company Voluntary Arrangements – not Just for Retail or Restaurants

Company Voluntary Arrangements are not just for retail and restaurants. Our London Team has used one to save Dinosaurs in the Wild from Extinction.

Employee Benefit Trusts and the April 2019 Loan Charge

Employee Benefit Trusts and the April 2019 Loan Charge

50,000 people with Employee Benefit Trusts need to Contact HMRC by Sept 30th 2018 to try and avoid the April 2019 Loan Charge. Talk to us for help & advice.

Insolvency Practitioners and Financially Distressed Companies

Insolvency Practitioners and Financially Distressed Companies

Our Insolvency Practitioners in London report on Government plans for new tools to improve rescue opportunities for companies in financial difficulty.

Company Voluntary Arrangements, Landlords and Business Rates

Company Voluntary Arrangements, Landlords and Business Rates

Our London team looks at why landlords often agree to Company Voluntary Arrangements when doing so doesn’t offer them a great return? Business Rates are at the centre of things.