What is a Company Voluntary Arrangement (CVA)?

A CVA is an insolvency procedure that allows a company in financial distress that owes money to enter into an arrangement with its creditors to repay its debts, over an agreed period of time. From the commencement of a CVA, a company can continue to trade even though it is insolvent. A CVA can only be supervised by a Licensed Insolvency Practitioner.

Often a company with a seemingly healthy business can find itself with cash flow problems and creditor pressure due to a one-off event. This can lead to it facing insolvency. One such circumstance could be the insolvency of a major customer, a contract going badly wrong, or significant rent increases by landlords. How can we help? Here, a Company Voluntary Arrangement (CVA) is often used to restructure the company and return it to financial health.

Need help?

If your business is facing insolvency, the sooner you contact us, the more we can help.

Learn more about CVAs

When is a Company Voluntary Arrangement used?

A CVA is used if the insolvent company has already or is likely to return to profitability in the near future and the debts can be paid off over an extended period of time. It is in effect a sort of debt-reduction / debt-settlement process, the CVA being a tailored plan to repay the money owed to creditors, usually over a 3-5 year period, based on what the company can afford to pay. Typically, this is between 25% and 60% of the total debt. This gives the company time to reorganise and to turnaround the business.

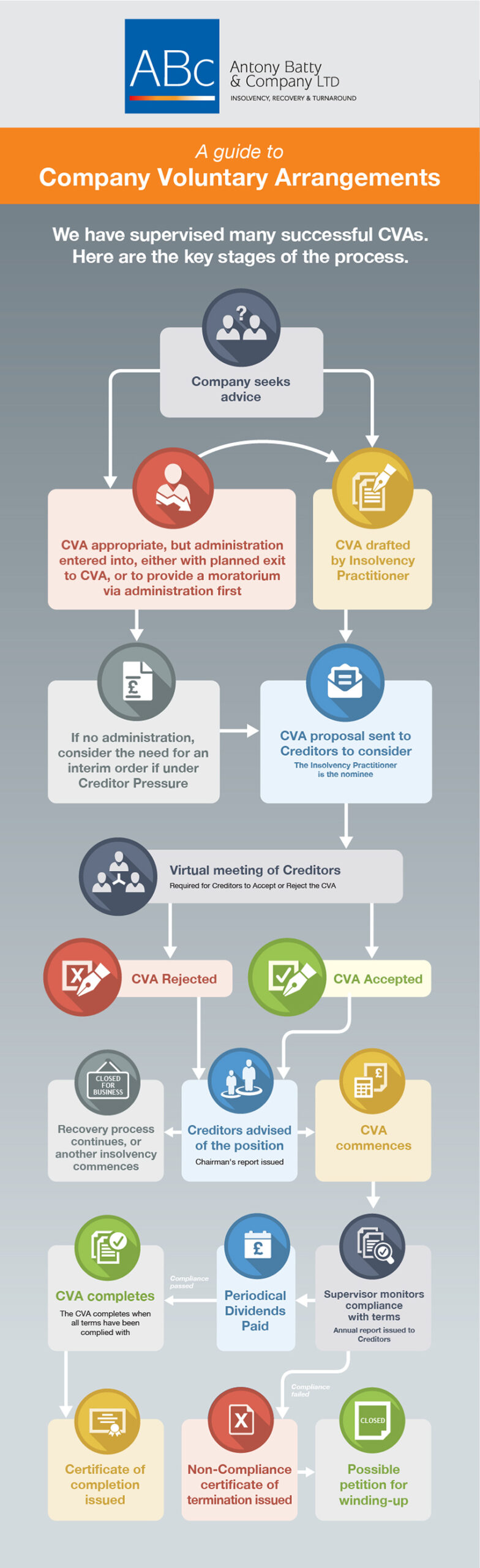

Take a look at our guide to the Company Voluntary Arrangement process (which includes the main advantages of using a CVA) and scroll down this page for some Frequently Asked Questions. There have been rumblings for reform of CVAs in recent years – take a look at our article about this debate, plus take a look at this article for a comparison of CVAs with Pre Pack Administrations.

A guide to Company Voluntary Arrangements

via Google Reviews

How can a CVA help? What are the advantages of a CVA?

A Company Voluntary Arrangement is a contract between a company and its creditors that is legally binding on all concerned. If approached in a proper manner it can give an insolvent business breathing space to resolve its financial problems, take control of, and recover, its financial footing. A CVA offers a very flexible approach to an insolvent situation and, therefore, can be tailor made to your company’s needs.

Get out of debt with a Company Voluntary Arrangement

Initially, an Insolvency Practitioner (IP) is the nominee when a CVA is proposed. The CVA has to be approved by 75% or more (by value) of the creditors. If approved, the IP will become a Supervisor and will enforce the arrangement and become responsible for ensuring the agreed terms are met. If there is an objection or objections to the terms by more than 25% of the creditors (by value), the CVA cannot proceed.

CVA FAQs

Any Company Voluntary Arrangement (CVA) must follow the procedure set out in statute. Our Licensed Insolvency Practitioners will assist the Board of Directors and the Company with the preparation of proposals for a CVA and arranging the subsequent meetings of creditors and of the Company to seek approval of the proposals, including drafting notices, minutes and other documents where appropriate. However, the ultimate responsibility remains with the Board.

We must set out our changing role and discuss the options available in a fair manner and consider the Company’s circumstances before you decide on an appropriate solution to its current difficulties. When the Board is happy that it understands the options and our advice, it will be asked to confirm that it agrees.

We will help to draft the Company’s proposals and Statement of Affairs from information that the Board provides, but the Board should note that they remain their documents and the directors may be held liable if they omit information from, or include wrong or misleading information in, the proposals that others subsequently rely on when approving the proposals.

In addition, if any information is omitted, or incorrect or misleading information is included, the proposals may be rejected or any approved CVA may be challenged. This could result in the Company being in a worse position than if it was wound up now without first attempting a CVA.

We will help draft and submit notices to the Court and the Company’s creditors in connection with the decision procedure to approve the proposals. If any creditor is threatening or taking court action, the Board should advise us as a matter of extreme urgency so that we can consider applying to have their action halted while the proposals are drafted and submitted for approval.

Once the Company’s proposals are finalised and the required notices have been issued a decision of your creditors will be sought to consider the proposals. Proposals for a CVA are only approved when 75% or more of those voting in the decision procedure have approved them. Creditors may propose amendments to the proposals at the meeting and if they do the proposals cannot be approved until the directors have agreed to the modifications.

The forthcoming interview will deal with some common modifications so that the Board have some advance warning of potentially onerous modifications and so do not have to make a decision without time to consider them properly.

After the appointment, the CVA Supervisor is required to issue a variety of notices for the attention of the court, other statutory bodies, such as HM Revenue and Customs, Companies House, and the creditors generally.

Once appointed Supervisor of a CVA, our partner’s main duty will be to the creditors, to monitor the progress of the arrangement and enforce the arrangement terms, including any modifications that may be proposed and accepted by the directors and the creditors. If the Company is unable to maintain the arrangement payments, or otherwise defaults on the agreed terms, the Supervisor may have to fail the arrangement and potentially could even have to petition for the Company to be wound up.

The Board will be required to cooperate with the Supervisor in providing information about the Company’s income and expenditure and copies of its management and other accounts from time to time and making any increased payments that he may require.

It is important that the Board realises that if the Company enters a CVA which subsequently fails resulting in the Company being wound up, the Company may be in a worse position than if it was wound up now without first attempting a CVA.

The Supervisor will deal with enquires from you and the creditors promptly and will report periodically on the progress of the arrangement, including the level of costs, any changes and any other sources of income for the Supervisor or the practice in relation to the case. The Supervisor will report if the costs of the arrangement increase beyond previously reported estimates and will close the CVA promptly on completion or termination.

We will not be able to start drafting proposals until we have received all of the information requested in the engagement letter, together with an updated business plan and cashflow forecast and details of the measures that you intend to take to avoid recurrence of the Company’s financial difficulties.

Failure to provide any of the information could delay the whole process. When drafting proposals, we may require further information and we will need some documentation signed and returned. Failure to provide prompt answers to queries or delay in returning signed documents could result in delay. It is essential that you provide complete and accurate information about all of the company’s assets and dealings.

Providing inaccurate or misleading information in an attempt to procure approval of an arrangement is an offence and could result in delay or rejection of the proposals. If it is discovered after the proposals have been approved, it could result in the failure of the arrangement and the Company may be wound up.

You should complete any outstanding tax returns and submit them to HMRC before the proposals are issued to creditors. HMRC will not approve proposals if returns are outstanding so failure to complete the returns could result in delay or the rejection of the proposals.

If a creditor is bound into the arrangement without receiving notice then they can appeal to court. Similarly, any creditor can appeal to court within 28 days of the approval of the arrangement if they consider that they have been treated unfairly or they can show that the arrangement should not have been approved.

Exceptionally, it may be possible for a creditor to appeal out of time if the court permits and the company and the creditors can apply to the court to have any act, omission or decision by the Supervisor reviewed.

The court can make whatever order it sees fit in the event of a challenge or appeal. It may revoke the approval of the arrangement with or without ordering that a fresh meeting of creditors should be convened. It can order specific action by the Company or the Supervisor to rectify matters and it can make an order for the costs of any application and complying with any consequential orders.

If the CVA is not approved, the Company will remain in its current situation. It will have no protection from recovery action by its creditors and the Board will remain in control of it. We will be able to advise the Board further in that situation, but it is likely to need a further insolvency procedure.

Because of the delay caused by proposing a Company Voluntary Arrangement, the Company may owe more money and may be in a worse position than if it entered an alternative insolvency procedure now without first trying a CVA. If a creditor has petitioned for the Company to be wound up and has suspended action or had the petition adjourned to allow the proposals to be considered, then if the proposals are rejected, they may be able to get the Company wound up quickly.

If the proposals are approved by the required majority, but the CVA subsequently fails, the arrangement terms may require the Supervisor to petition for the Company to be wound up. Because of the time elapsed, costs incurred in supervising the arrangement and additional cost of petitioning, the Company may be in a worse position than if the Company were wound up now without first attempting a CVA.

As an alternative to petitioning, it may be possible for the Company to be wound up voluntarily, by way of a CVL, with the Board convening meetings of the members and creditors to place the company into Liquidation instead of applying to court for a winding up order. In some circumstances this can be a quicker solution than applying to court.

Another possibility is that the Company may be put into Administration if there is a chance that the business can be preserved or that a better result can be achieved that way rather than immediately entering Liquidation. If that happens an Administrator has a range of options he can pursue, including, but not limited to, trading the Company before either selling the whole or part of it, arranging for an immediate sale or all or part of it without trading, or simply closing the Company down and disposing of the assets.

It is even possible, but less likely, that the Arrangement could be terminated without further action, leaving individual creditors to take enforcement action in due course that might result in action to recover assets or a petition for winding up.

If the debtor company does not comply with the CVA’s terms – and it is compulsory that it does so – then:

- The Supervisor may petition for a Company Liquidation through the Courts.

- The creditors of the debtor Company are no longer bound by the terms of the CVA. This means they can pursue debt recovery from the debtor Company for the balance of the debts that are owed.

- The CVA Supervisor must distribute any assets that they hold in partial satisfaction of the company’s debts.

There is no statutory requirement for the Directors to advise their customers that the company has entered into a CVA. However, it may be in the Company’s interest that the Directors are upfront with their customers for the important reason that rumours may spread in the market place that because the Company is insolvent it may be about to cease to trade.

The Directors can explain to the customers that the CVA will enable them to focus on the service they provide rather than concerning themselves with the Company’s financial position. Loyal customers may look to help the company for example by ensuring prompt or early payment for goods and/or services provided.

Key trading partners of the business should be aware of what is going on. A controlled approach to key customers will be much more beneficial than allowing them to hear from Creditors who have received the proposals.

There is no reason why the CVA will prevent a Company from delivering a reliable service. Moreover, it offers the chance for a struggling yet viable Company to continue to satisfy its clients. There is therefore no reason why customers would walk away from a Company that has chosen the CVA route.

Whether the Company decides to inform the customers is the prerogative of the Directors. However, it is important to consider the value of honesty when your customers’ only other sources of information may be your competitors.

Clients will take the view that the new contract is as a result of the quality of the company’s product and or service, but the customer will be checking the Company’s ability to fund itself and to be in business some months or even years down the line. Communication and a controlled approach will usually lead to a positive outcome. Your Insolvency Practitioner will be able to give advice.

Whilst there may be fears that creditors will vote against the proposals, it is often in the best interests of the creditors to work with the CVA process rather than against it. Creditors will ultimately want any debts owed to them to be paid back. More than often, if the business is viable, they will want to continue working with the company. It is important to be honest with the creditors throughout the process.

They will be disappointed, but by proposing a CVA you are showing them that you are trying to continue a business that will maximise the return on current debt to the creditors.

It is all about communication. The best strategy would be to talk to them asserting that the company is seeking to maximise all creditors’ interests by proposing a CVA.

It is likely that some employees will have to be made redundant as part of the process of restructuring and streamlining the business. However, there may be a concern that staff vital to the business going forward may decide to leave.

Generally, they will stay. If they walk out they lose their employment rights and will not receive any redundancy or lieu of notice payments from the company, or the Government should the Company be forced into Liquidation. They may also not be eligible for unemployment/job seekers benefit.

It is our opinion that you must involve employees in a CVA when the time is right, because they are the people who are going to help deliver management’s plans.

If they have a new job to go to there is little to be done to stop disgruntled employees leaving. But if the employees can be involved as part of the recovery – perhaps by offering a share package as part of the long-term strategy the key employees can often be retained.

Again, this is unlikely to happen. If a well-structured plan is used and a well-presented approach to the bank is employed.

Most banks are much more supportive now of “out of court” restructurings like CVAs because they avoid the usual huge asset meltdown and costs of an Administration, for example. Although the CVA cannot affect the rights of the bank or lender, they are stakeholders and should be closely involved in the process.

Then approach the bank. The local branch manager must pass the proposal to his debt recovery unit and cannot (usually) affect the outcome of the deal.

Remember the bank is (usually) secured, therefore the CVA cannot bind the bank legally, but conversion of the overdraft into a longer-term loan may give the bank more comfort that the company is keen to repay the debts. Talk to an Insolvency Practitioner used to dealing with banks, such as Antony Batty & Company.

They are guarantees that cannot be removed unless and until the debt is paid off. The longer-term repayment to secured creditors should be considered as part of the overall restructuring. Once the debt is cleared there is no reason why Personal Guarantees cannot be removed.

A CVA will not lead to these being “called in” as long as a careful plan to deal with secured debt is set out to the lender. Again, banks don’t want to chase people for PGs. They want to lend to responsible and viable businesses.

No. They can be used in future providing they are recognised losses.

Yes there are two methods: one relies on case law and the other is a formal moratorium. For a full explanation of how the new Acts moratorium process works talk to a specialist turnaround practitioner or an insolvency practitioner.

Under case law, providing a creditor has less than 25% of the overall debts of the company then they can be required to consider the proposal even when a winding up petition is issued. A petition may be stayed and adjourned if a carefully structured plan is put together.

If required a CVA can be rapidly prepared to show there is a “reasonable prospect” of the CVA being approved, then the Court will usually adjourn a hearing allowing time for the proposal to be completed and voted on by creditors. This is a complex issue beyond the scope of this guide, but feel free to contact us if you have any questions.

In 1995 case law was reported that provides a very powerful argument. Re Dollar Land (Feltham) & Ors [1995] BCC 740 reported that the court decided that a winding-up order should be rescinded if there was a real prospect that CVA proposals would be approved by the company’s creditors. In other words, let the CVA majority decide.

We use this argument to STOP petitions being issued in the first place, saving the creditor money for costs and fees and also removing the risk of the petition being made against the client.

If a petition is already issued before we have been appointed to assist, and a hearing date is due before we can file the CVA meeting notice, we talk to the petitioner to persuade them to stop their actions, or to prevent the advertisement of the petition.

If the petitioner will not withdraw or threatens advertisement the Company could use an application to Court to request a hearing adjournment and seek a Validation order from the Court saying that the hearing is adjourned and the company can progress the CVA proposal to filing and call a creditors meeting.

An Insolvency Practitioner appointed to supervise the carrying out of a Company Voluntary Arrangement.

TUPE refers to the Transfer of Undertakings (Protection of Employment) Regulations, 2006. TUPE protects the rights of UK employees when a business or service transfers to a new employer.

Looking for an experienced Insolvency Practitioner? We have run over 200 successful Company Voluntary Arrangements

We believe a Company Voluntary Arrangement provides an excellent opportunity for an insolvent Company to survive, clear its business debt and for the creditors and lenders to recover far more of their debt than they would in a Liquidation or through the sale of the assets of the company.

Over the years we have built strong contacts with a number of funders who are willing to inject working capital into a business once its old debts have been ring fenced in a CVA and debt solutions are in place.

Take a look at a CVA case study involving the restructuring of LSE listed companies.

Our team of Insolvency Practitioners, in London, Brentwood, Salisbury, Bournemouth and the Thames Valley have used Company Voluntary Arrangements to help over 200 companies that have encountered short-term difficulties. In c.70% of the cases the CVA has allowed them to undertake debt restructuring and reorganisation plans, return the Company to profitability and trade on successfully.