Mental Health and Insolvency – Useful Resources

In March 2021 we reported on the stresses and strains that insolvency can cause amongst those who are going through it, whether via a company as owners, directors, manager and employees or as individuals. The effect on mental health, including depression and anxiety is very real. The Money and Mental Health Policy Institute found that 18% of people with mental health problems may also suffer with debt issues and that 46% of people in problem debt also have a mental health problem. The report suggested that c.1.5 million people struggle with Mental Health issues and problem debt at the same time and that the situation can be made worse if they are treated insensitively by creditors.

We at Antony Batty & Company LLP understand that your debts and subsequent insolvency will affect your physical, mental and emotional health, and that they in turn will have had an effect on your finances. This is a well-known fact and is nothing to be ashamed about. If you are suffering from stress, anxiety or depression, have difficulty in reading, cannot retain information or just need help in dealing with or understanding any aspects of your debts, or those of your company or business, then there are many not for profit organisations who can help you navigate the complexities of the insolvency process you may find yourself in. Similarly, there are many counsellors who can help you with any mental or physical health issues and who will be able to provide you with the help and support you will need over this very difficult period.

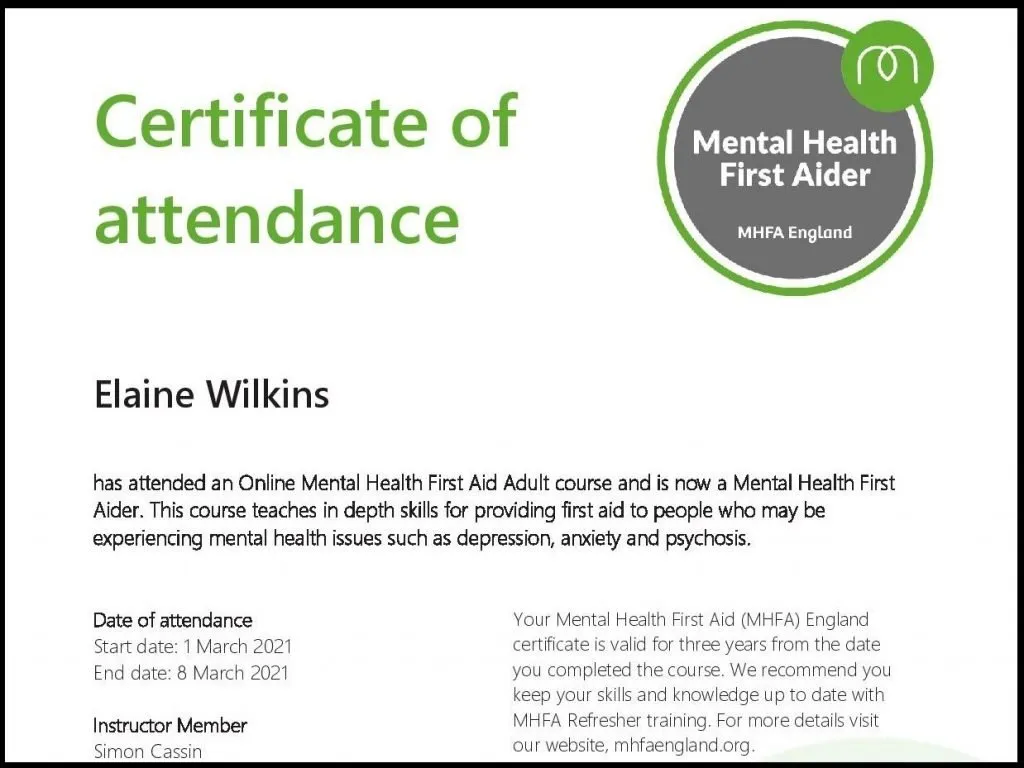

Elaine Wilkins from our Bournemouth Office is now a Mental Health First Aider

As Elaine says:

“Over a period of time, I received my online Mental Health First Aid training, which amongst other things, trained us to recognise the signs of depression and anxiety and what steps to take to help those with difficulties, especially when it becomes obvious that a simple reassuring chat and some kind words isn’t enough.”

“Having completed the training, I am now a Mental Health First Aider, and I will be using my new skills in this area to help any of the individuals and businesses who approach us when their finances are in real difficulties and they realise they need help.”

“The stories of sleepless nights, growing anxiety and deepening depression are all too true for those individuals and business owners who are facing problem debt and, ultimately, insolvency. Sometimes our advice is sought too late, and the only way out is a liquidation. Even then, we can help lessen stress and strain by taking over the work of dealing with creditors. If contacted quickly, the chances of turnaround and recovery are much improved, perhaps via an Administration or a Company Voluntary Arrangement, where once again, we take the strain.”

For free debt, legal & tax advice advice

Business Debtline

Business Debtline provides free advice and resources to help small businesses and self-employed people deal with their business and personal debts. Advice is available over the phone, or via webchat.

https://www.businessdebtline.org/

Citizens Advice

Provide free, confidential and impartial debt advice service. Citizens Advice staff get specialist training on how to deal with clients with mental health problems. If you disclose mental health problems early, it will help advisors to help you.

https://www.citizensadvice.org.uk/

National Debtline

Provides free advice and resources to help people deal with their debts. Advice is available over the phone, online and via webchat.

https://www.nationaldebtline.org/

StepChange

As well as a full debt help service, StepChange provides extra support to vulnerable people, including those with mental health issues, for example, help completing forms or with benefits checks. StepChange says it’s important to let its counsellors know about your condition, so you can get additional support.

TaxAid

Charity giving free advice for people on low incomes about tax issues.

Civil Legal Advice

Provides legal advice on issues such as where your home is at risk for those on benefits or a low income.

Shelter

Provides advice, support and legal services to those that are homeless or facing eviction. They can also help with benefit claims, budgeting and crisis loans.

Useful sources of support and information on Mental Health and Wellbeing

- The BBC – Your Mental Health Toolkit

- The NHS – Looking after your Mental Health

- Mental Health Foundation UK – Good Mental Health for all

- Mind – We’ll listen, give you support and advice, and fight your corner

- Samaritans – Run a confidential listening service

- Shout – Provides a confidential text service for anyone in crisis

The Money & Mental Health Advice Service

A site aimed at helping you understand, manage and improve your mental health and money issues, run by Mental Health UK.

https://www.mentalhealthandmoneyadvice.org

Anxiety UK

Offers supports for people living with anxiety disorders by providing information, support and understanding through a range of different services.

Hafal

Provides advice and support to individuals living in Wales who are experiencing a serious mental health illness.

Rethink Mental Illness

Run a national helpline as well as local services and support groups for people living with mental illness, their carers and relatives.

Sane

Provides emotional support and information to anyone affected by mental illness.

Signhealth

We are here to improve Deaf people’s health and wellbeing

Video Links

Advice for specific conditions

Alzheimers’ Society

Provides local info and services across England, Wales and Northern Ireland to people affected by dementia.

Bipolar UK

Provides information, support and advice for people affected by bipolar disorder. Membership costs £20 a year (£10 unwaged) and includes access to a free legal advice line, travel insurance scheme and self-help groups.

Combat Stress

Charity providing free services for ex-service men and women with conditions such as Post Traumatic Stress Disorder (PTSD), depression and anxiety disorders. Support can be residential, community-based or financial.

The sooner our help and advice is sought when insolvency looms, the better

If you or your company is facing insolvency due to problem debt, HMRC arrears, cashflow or other financial problems and you are stressed and anxious about what to do, then please do contact us for a fully confidential, and FREE initial discussion at our Bournemouth office.

At the meeting, our highly qualified specialists will provide you with independent, professional assistance/guidance and go over all the possible options, to help take the stress and strain away.

You can contact Elaine at elaine@antonybatty.com or via private message via LinkedIn