Prohibited Names – A Minefield for Directors

Prohibited Names – A Minefield for Directors

The use of a Prohibited Company Name can lead to a fine, disqualification or prison – and possibly personal liability – for the Director. Our Insolvency Practitioners in London can advise.

HMRC to Become a Secondary Preferential Creditor

HMRC to Become a Secondary Preferential Creditor

Our London Team of Insolvency Practitioners comment on HMRC being reinstated as secondary preferential creditor. What are the implications for insolvency?

Insolvency Practitioners and Financially Distressed Companies

Insolvency Practitioners and Financially Distressed Companies

Our Insolvency Practitioners in London report on Government plans for new tools to improve rescue opportunities for companies in financial difficulty.

Antony Batty Insolvency Practitioners – 21st in top 100 Insolvency Practices

Antony Batty Insolvency Practitioners – 21st in top 100 Insolvency Practices

Our Insolvency Practitioners in London, Essex, Salisbury and The Cotswolds rank 21st out of the top 100 practices in Britain in the Insolytics League Table. We deliver results at sensible prices. FREE initial consultation.

Are All Insolvency Practitioners the Same?

7 Factors That Make a Good Insolvency Practitioner

The advice from, and expertise of, Licensed Insolvency Practitioners can help financially stressed companies turnaround and recover. But what makes a good IP?

Insolvency Practitioners and Estate Agencies in Financial Distress

Why are Estate Agencies Facing Increased Levels of Financial Distress? The Brexit Effect?

Is it the Brexit effect? Or, are there other reasons why there are 46% more estate agents in financial distress than a year ago? Our Insolvency Practitioners comment.

Our Insolvency Practitioners Review of 2017

2017 was a Busy Year for the Licensed Insolvency Practitioners at Antony Batty & Company

We were appointed to handle 101 insolvency procedures, we recruited 4 new staff, made 3 promotions and we turned 20. Plus we ranked 16th in the Insolytics League Table for Insolvency Practitioners.

Facing a Tax Demand Because of an Employee Benefit Trust? Insolvency Practitioners can Help

HMRC is Aggressively Collecting Tax on Companies with Employee Benefit Trusts. Act Now!

HMRC appears to be winning the battle over EBTs and APNs, which could see a spike in insolvencies as some companies might not be able to pay the tax owed. We can help.

HMRC, Restaurants, VAT and Insolvency Practitioners

HMRC Gets Tough on ‘Tax Avoidance’ by Restaurants. £160,000 VAT owed and £50,000 fine for Kebab Shop.

In this case study, a restaurant went into liquidation due to this unaffordable tax liability imposed by HMRC for alleged tax avoidance. We could have helped if called in soon enough.

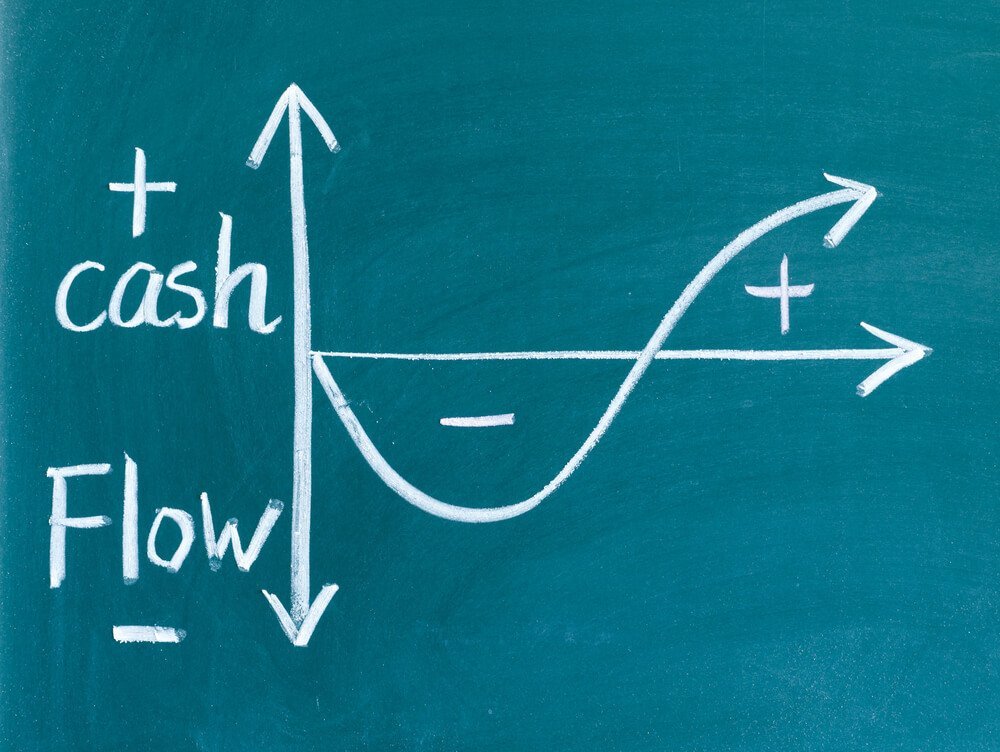

The Importance of Cash Flow. Insolvency Practitioners can Help

Cash Flow Monitoring is Vital. How Good is Your Company’s?

As the new year of 2018 dawns, it seems a good time to reiterate that cash flow is a pivotal tool that is necessary for established business and even more so for new start-ups.